NAIFA WA was represented well in Olympia on January 29th

when dozens of members met there to discuss our business with legislators. On

the same day, NAIFA WA was in Washington DC, on The Hill, doing the same

thing. Richard Miller of NAIFA Central

WA, Alex Collins of NAIFA Seattle/Eastside and Richard Ek of NAIFA Snohomish

County met with staff working for five legislators in “The Other Washington.”

We had spent the previous day in training with NAIFA leaders, lobbyists and

other experts.

We met with the Chief of Staff for Representative Jim

McDermott and legislative aides and directors for Representative Dave Reichert,

Representative Susan DelBene, Senator Patty Murray and Senator Maria Cantwell. In every meeting we found the staff willing to

listen to our message. Also, each office welcomes our contact with email

updates on issues important to our clients (their constituents) and our

industry. All indicated we were welcome to come back in April when NAIFA holds

the Congressional Conference on the 8th and 9th. NAIFA expects to have close to 1,000 members

for that event.

A few of the things we learned in the two days:

·

Senators and Congressmen have an average of 13

meetings a day which means it is not easy to “see” them. Thus we meet with

aides more often than not. Just the same, the elected officials rely heavily on

the information gathered by their staff

·

Ed Woods and his brother, Lawrence, met with

President Wilson in 1913 and convinced him to amend the income tax legislation

to give preferential tax treatment to the products we sell. We face the same

challenges this year – it requires all NAIFA members to be involved by

participating in the only political action committee that works for you every

day; IFAPAC

·

NAIFA CEO Susan Waters meets with HHS Secretary

Kathleen Sebelius and other top leaders to tell our story

·

Brad Fitch talked about “learning to hug a

porcupine,” about our rights guaranteed in the First Amendment which forbids “the

making of any law prohibiting the petitioning

for a governmental redress of grievances.”

·

In-person visits from constituents are 5 times

more effective than lobbyist’s visits

·

HB 2758 came about after a patient in his

doctor’s office was presented with paperwork to complete while he was undressed

(clothed in an examination gown). The patient lobbied his congressman who

authored what became known as the “Stark Naked Act of 1997.”

·

Advocates using Social Media can influence

legislation – 64% of legislators say they follow Facebook posts so follow your

legislator! 20-30 comments on a topic gets their attention. They also follow

Twitter

·

The first and second lines of a letter (or

email) are the most important. Establish your credentials and state your “ask.”

·

NAIFA’s goal for 2013 is to have 13,000

contributors which means we need to broaden our base in Washington to about 400

or double what we now have

·

In the words of Terry Headley, past President of

NAIFA, “We practice practical politics” which means we contribute to members of

both parties

None of you reading this are ignorant of the economic

problems facing our government. You are also aware that our industry (life

insurance, annuities, qualified plans, employee benefits) are seen by many in

Washington as a potential revenue source. If they can wipe away the preferential

tax treatments currently in place they believe a large percentage of the

current debt can be paid. It is frustrating that too many in Washington have no

idea how important our products and services are to their constituents/our

clients: Middle Americans.

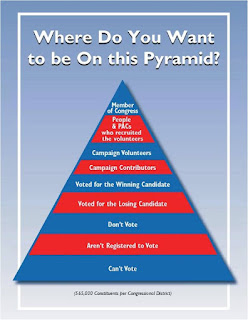

What will YOU DO to join the other 197 IFAPAC participants

in NAIFA WA? Will you sign up today? Will you add $10/month to help insure that

your clients can continue to protect their families and businesses with life

insurance? Will you help in the fight to retain the tax incentives that your

clients enjoy when saving for retirement using life insurance, annuities and

IRAs? Will you do what you can to help maintain the favorable tax treatment

your clients have with their medical benefits? We can’t say it enough – If Insurance Is Your Profession, Politics Is Your Business.

IFAPAC Chairman